by MICHAEL BODEEN | Oct 6, 2014 | Bodeen Team Blog, Real Estate News, Realtors

What we saw in toward the end of the third quarter, as I mentioned before, is a drop in supply that helped us get back to a balanced market, not favoring sellers or buyers. It seems however that we should not get too excited as there are many factors that are still counting against sellers right now.

It appears that even though there have not been a whole lot of new listings, in fact very few, demand has also begun to weaken a little from the low it was already at. The amount of listings that are pending right now has dropped nearly 6% from last month, indicating a drop in demand. The total inventory or supply of listings is up 2%, conversely indicating an ever so slight increase in supply.

Market experts are predicting an increase in listings until Thanksgiving, at which point it is expected to drop down again. What does this all mean for sellers? Well it’s a tough road right now, which means we have to be competitive in price, the best presentation possible, and a little bit of patience… ok, maybe a lot of patience.

As professional Realtors, we often tread the fine line of staying optimistic, but also reporting negative facts taking place on the ground. Thankfully, we can remain optimistic because we enjoy where we live and life is good, except when it’s not – and that’s life. If I am a person who really enjoys my home and the memories it affords me, then I’m not that concerned about what the local real estate market is doing. Least of all week to week or month to month.

I do however confess to having a penchant for being a market observer, and the main reason for that is that 90% of the time when I see a client, even casually apart from biz, they inevitably ask, “Mike, how’s the market?” I’d like to be able to intelligently answer them something other than, “I dunno.”

So when we find ourselves in the languid real estate market that we are, we need to come up with the right spin, and in this case, currently, there is an honest spin that works. Here it goes: Fence sitters, your time has come, get your financial house in order, and get ready to buy a house shortly, because there’s going to be some great buys between now and the end of the year. “I dunno Mike, sounds like Realtor hype to me.”

The truth is that we’re seeing (literally) hundreds upon hundreds of price reductions weekly. If you combine that with very low mortgage rates, and a jobs economy that’s turning around, it may very well result in a booming market. When that happens, just as in our not too distant past, prices escalate rapidly and then, in the words of Carole King, “it’s too late baby, now it’s too late…”

– Mike Bodeen

![HOAs…. Love Em or Hate Em? (Part 3)]()

by MICHAEL BODEEN | Sep 29, 2014 | Bodeen Team Blog, Real Estate News

Part 3: Get Informed First!

(HOAs Part 1)

(HOAs Part 2)

(This is the 3rd and final article regarding HOA’s – Previously we looked at the advantages and disadvantages of living in an HOA community. Today we look at the importance for buyers to understand exactly what they’re getting involved in and the best way to go about checking it out ahead of time)

Most homebuyers are not immediately concerned with a community’s homeowner association (HOA) rules and regulations unless they’ve already had their “experience” — like my client who wrote me following the first article in this series. Because of how he felt he was treated, he may not ever own a home in an HOA again. I think it’s also fair to say that his experience in his community is NOT like most communities.

The main question I get is how much are the monthly HOA’s (dues amount)? The second question is typically, “what do the dues cover?” But honestly, one of the most important parts of our AAR Purchase Contract is the HOA Addendum. Every purchase of a property in an HOA is now required to follow the rules spelled out in this addendum (partially reprinted below) because the myriad legal problems surrounding HOA’s have now become legend. I think however that HOA’s do not provide everything they’re supposed to, so it’s good to make sure they do. (See the requirements below)

Along with the requirements below there is another bit of information which may tell more about an HOA than anything else – that is the meeting minutes. There is no formal requirement in the HOA Addendum for anyone to provide these — that request needs to come from the buyer in their offer. If obtained however, the minutes can reveal important information about the HOA including, but not limited to, future capital improvement projects and associated costs, lawsuits affecting the community, ongoing HOA violations, board member perspectives, quality (or lack thereof) of work being done in the common areas, such as landscaping, painting, etc. and much more.

By law, a prospective buyer in an HOA MUST receive from the HOA:

1. A copy of the bylaws and the rules of the association.

2. A copy of the declaration of Covenants, Conditions and Restrictions (“CC&Rs”).

3. A dated statement containing association contact info, the amount of the regular assessment, special assessments, fees or charges currently owed by the seller, insurance, reserves, current violations by homeowner, statement of seller alterations, case information related to lawsuits, current operating budget, annual report, most recent reserve study, and any other information required by law.

Most importantly, whatever community you choose to consider living in you can learn a lot about its character and history by talking with the neighbors. A good time to do this is on a Saturday morning. (Just make sure you do this before the end of your ‘Due Diligence’ contract period, talk to neighbors) Most folks will be pretty honest about living there, including their experience with the HOA. You can learn a lot that rules, regulations, and financials won’t show you. In some cases you might learn some things about the house and (owners) you’re buying from. Of course, it’s also possible you would have preferred NOT to have known some uncovered juicy morsel. As a caveat, take everything said with the proverbial grain of salt.

If after all that, there’s any reason why you don’t want to buy this property, excepting fair housing issues, you can elect to cancel the agreement without forfeiture of deposit.

by JONATHAN BODEEN | Sep 23, 2014 | Bodeen Team Blog, Buying a Home, Real Estate News, Relocation

The choice to buy or rent has always been a difficult one, and the answer is not always the same for everybody.

In the beginning, buying a home IS more expensive than

renting. You need money for a down payment, closing costs, and

maybe even some new furniture!

But in the end, buying your home and holding onto it for the

long haul is almost ALWAYS the smarter financial move. Why

you ask?

1. The cost of your mortgage will remain fairly consistent even as

prices around you move up and up due to inflation and other

reasons. So even if your monthly payment is more in the first few

years, eventually you will actually be paying less than those

who are renting around you!

2. After paying a mortgage for 30 years, what you have is an asset

worth hundreds of thousands of dollars and no more mortgage

to pay! After 30 years of renting what do you have? Uhh… more

rent to pay.

Buying a home can be a scary thing, and don’t be deceived; it is

not something that should be done casually. It does require

planning and a personal assessment of your budget vs. the costs.

I do personally believe however, that it is something that every

reasonable individual or family should work and plan towards.

The first step is always to figure out where you stand financially

and what you can afford. The best way to do that is to speak with

an experienced loan professional. You may be surprised what is

out there in your budget! For example, if you’re paying $1000 a

month in rent, that translates to the monthly cost of a

$150-160,000 home, given today’s interest rate.

Give me a call and I can put you in touch with an experienced

loan professional that can analyze your options at no cost or

obligation. Even if you find you’re not quite ready to buy, at least

you will have a place to start and can begin planning for the

future.

The longer you wait in life to buy your first home, the longer it will

be before you can stop paying rent or a mortgage forever!

![HOAs… Love Em or Hate Em? (Part 2)]()

by MICHAEL BODEEN | Sep 22, 2014 | Bodeen Team Blog, Buying a Home, Real Estate News

(Last week we discussed the “Benefits of an HOA!” This week we’ll look at some negatives)

(Click here for Part 1)

HOA’s Run Amok!

“Gestapo Tactics!” is the term I’ve heard more than once when homeowners are venting about their HOA.

An overzealous HOA can be a royal pain to homeowners. Usually after one or more written warnings, a property owner may receive a formal complaint and directive to fix an HOA rules violation. If not fixed within that certain period of time, or after numerous warnings, a fine is assessed. When this happens the homeowner-HOA relationship heads downhill in a hurry, usually to crash and burn. And, in some cases we’ve heard that HOA’s have the authority to foreclose on a property after non-payment of fines following due process.

Often the cause for the HOA violation has to do with tenants in the home, who may or may not be aware, or who may or may not care that their car was left parked on the street overnight. In some communities, hired staff drive the hood and take photos of violations to present to the homeowner. This one enforcement detail, which is usually necessary to make a charge stick, often ticks off an owner or renter more than anything else. It’s akin to getting the photo enforcement mug shot from the City of Scottsdale in the mail.

Another cause for upset homeowners is their perception (often correct) that the HOA is being unreasonable when they turn down a homeowner request for adding or changing something to the exterior of the house. When a buyer asks us if they can “do a certain thing, or make a certain change,” our immediate comeback is that it’s up to the community rules and regs (or Design) committee – and sometimes what side of the bed they got out of that morning.

And sometimes you can be torpedoed by a neighbor. I spoke with a client recently who had called me to see if I had the number of a good HOA attorney. His next door neighbor in North Scottsdale was taking issue with his backyard new pool and landscape project and was making a fuss to the HOA which ended up delaying the project many months, missing the swim season. Fortunately he has recently gotten this resolved, but it was a real headache for him and his wife.

Don’t like the way your community is being run? Well, you can make your voice heard at a monthly HOA meeting, and you can even run for a position on the HOA board. Warning though, this position is not for the faint of heart.

I definitely touched on a nerve for some of you last week. One of my clients replied back with the following (this is a partial excerpt of what he wrote):

“HOA’s, I don’t like them!”

“They become power hungry controllers run by people who have nothing better to do and butt into everyone’s business. If I had it to do all over again I would find a neighborhood without one.

All the items you mention as unkept yards, cars on jacks can dealt with utilizing existing city codes. Yes they become like a mini Gestapo – personal experience.

Garage inspections to see if you have room to park, rigged elections, legal threats, fines, etc.”

(Next week we’ll discuss purchase contract issues that can save you hundreds of dollars, just by understanding what the purchase contract addendum states)

![The First Time Home Buyer’s Chronicles]()

by JONATHAN BODEEN | Sep 17, 2014 | Bodeen Team Blog, Real Estate News

A surly mercenary character on a TV series once said that a doctor should be shot in the leg before he learns to take a bullet out of other people… I suppose so he can empathize with his patient. Well, that may be extreme but there is definitely a hint of wisdom there.

I’ve been practicing Real Estate for three years now, one with my dad here in Arizona, and two years in Idaho before my wife Sarah and I had gone back to school. Soon we will actually be making our first home purchase, and let me tell you, I am definitely feeling the above mentioned shot to the leg!

We are going through a unique first time home buyer’s program called NACA. If you have been following my good father’s Realtory musings for any length of time you probably have seen it espoused on more than one occasion. Here is a quick refresher:

- No PMI (saves a couple hundred bucks a month on your mortgage)

- No down payment

- No (typical) loan closing costs

- Lower than market interest rate (as of the time of this writing it sits at 3.875% Wowsers!)

- Good credit not required

Some may think as I thought when the program was first proselytized to me, “Well this is just way too good to be true.” I do regret to inform you, dear reader, that there is still no free lunch, not now, not ever. There is a cost to the wonderful benefits you see listed above, but not what you might think. What is the cost then?

Time and energy.

You see most loan programs require about a 30-45 day turn-around time plus a few obscure documents such as pay stubs and W2s etc. NACA takes this to a whole new level, taking anywhere from 3-12 months and demanding a wide array of documents you didn’t know you were supposed to have. These include bank statements, letters of explanation for any and all anomalies on your credit report, a detailed list of prior residences and much more.

In short, NACA makes molasses look fast and the lines at the MVD look fun!

I note all of the negatives not to dissuade any from trying the program, but to set up an honest expectation. It truly is a great opportunity for people who currently do not own a home (one of the requirements) and may have other factors inhibiting them from obtaining a traditional loan.

We are in the thick of it now, and it looks like they will officially qualify us in October or November. As a self-employed person, the process actually becomes more sluggish. The simpler your finances, the more simple the process should be, the key word being should.

If you know anyone who might benefit from this program, give us a call or shoot us an email, we can help them get started and counsel them as to what to be prepared for.

www.NACA.com

The Bodeen Team

by MICHAEL BODEEN | Sep 15, 2014 | Mike's "Real State" of the Market, Real Estate News

It’s still a mystery, really. The inventory of homes for sale continues to drop. The amount of new listings that popped up on the market has been the lowest since July 2001. Amazingly, demand is also still dropping! In July we had the fewest amount of sales since July of 2008. It is certainly a unique situation, though I can’t say it’s bad.

According to The Cromford Report, “this is quite unusual and shows us how extreme the shortage of new listings has become. New listings have been arriving at a rate which is lower than in any August we have seen since 2001. In the last four weeks we saw 15.6% fewer new listings than last year and 13.2% fewer than in August 2012, the previous low record holder.”

The short of it is that we are now on the cusp of a balanced market here in the valley. As some of our clients can tell you, the summer has not been an easy one for sellers. inventory of homes (supply) was high and demand was low. Many of the listings on the market have either expired or been cancelled. Because of this summer’s buyer’s market, most sellers are now too timid to put their homes up for sale, which is the main factor driving the low inventory.

Ironically, this has actually created a much more balanced market, one that is more favorable to sellers than it was even a few months ago. We are no longer in a buyer’s market, we are at the threshold of balance. But how long will the decrease in inventory last? Well, that’s any ones guess.

The vast consumer mindset always seems to be 3 to 6 months behind what is actually happening in Real Estate. Most people believe we are still in the buyer’s market and have no idea it’s actually a much better time to sell than it was even a month or two ago!

To prove my point, here are the basic MLS numbers for September 1, 2014 relative to September 1, 2013 for all areas & types:

- Active Listings (inventory): 23,296 versus 18,182 last year – up 28.1% – but down 2.5% from 23,900 last month

- Pending Listings: 5,951 versus 7,302 last year – down 18.5% – and down 2.1% from 6,079 last month

- Monthly Sales: 6,417 versus 7,187 last year – down 10.7% – and down 6.2% from 6,844 last month

- Monthly Average Sales Price per Sq. Ft: $126.10 versus $119.38 last year – up 5.6% – but down 0.4% from $126.60 last month

- Monthly Median Sales Price: $196,000 versus $182,000 last year – up 7.7% – but down 0.5% from $197,000 last month

Regards,

Mike Bodeen

![HOAs… Love Em or Hate Em?]()

by MICHAEL BODEEN | Sep 15, 2014 | Bodeen Team Blog, Real Estate News

When setting up property search parameters for our buyers on the MLS (Arizona’s Real Estate Listing Service), we are sometimes asked to filter out HOAs (Home Owner Associations). Conversely, every once in a while we’re also asked to make sure that the property includes an HOA. Virtually every time when requested, it’s due to the prior negative experience of the buyer.

I’ve experienced both sides personally and professionally. And you know what? Even though folks feel strongly about HOAs one way or another, they’re not right or wrong — it’s simply a choice that each of us has. The most important thing is to know what you’re getting into and the potential downside.

This week we’ll cover the benefits of an HOA. Next week, we’ll look at the drawbacks. And finally, in the last installment I’ll cover what a buyer should know about the HOA from the perspective of the purchase contract. Just knowing what you’re agreeing to in a purchase contract can save or cost you hundreds of dollars

Benefits of an HOA!

As I see it, the benefits on an HOA are many. Homeowners within a given community pool their funds to pay for a few or many amenities, privileges or restrictions. The minimum responsibility that I’ve seen in an HOA community is for rules enforcement only. Typically the cost of this limited type HOA is $30 to $40 per month.

If for example, your next door neighbor (whether owner or renters) does not maintain their home, doesn’t maintain the lawn or weeds, or leaves a jacked up car in the driveway – all the time, then there is a process to get that taken care of. In some communities, hired HOA staff actually drive the neighborhood daily to look for these rule violations. I’ve heard the term “Gestapo Tactics” when related to this type of oversight. Strict enforcement may be a pain in the you-know-what, but guess what? That community is probably kept pristine. For many, there’s nothing more frustrating than having visual blight in the neighborhood that you see day after day.

The next minimum step up in HOA services and fees is for “common Area Maintenance.” This is where the HOA keeps up with the appearance of the neighborhood by cutting front lawns, keeping trees trimmed and trash picked up.

I can tell you from a buyer perspective when driving through “the hood,” that if there are unsightly yards or houses, or too numerous vehicles around, that is often a turn off, or more appropriately, a turnaround, where I turnaround the car and head to the next home. Just having these community rules alone can be very valuable.

Townhouse/Condo HOA’s are especially important because of the close proximity that people live near each other. Often these HOA’s are more costly because they may also include a monthly water, sewer, trash fee and cable charged by the association besides the maintenance of the community pool and the community gate or guard gate. Yes, you will pay for someone to keep the pool and spa clean and heated in winter even though you don’t use it, but many folks enjoy the fact that they have access to these amenities year round and don’t have to pay for it on their own property.

Don’t like the way the community is being run? Well, you can make your voice heard at a monthly HOA meeting, and you can even run for a position on the HOA board. Warning though, this is not for the faint of heart.

(Click Here for Part 2)

– Mike Bodeen

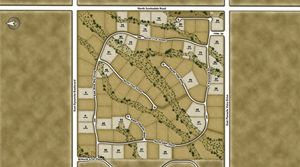

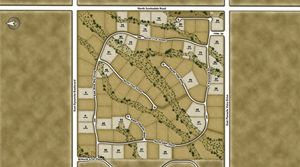

![Saguaro Estates]()

by MICHAEL BODEEN | Sep 9, 2014 | Featured Communities, North Scottsdale News, Real Estate News

Do you like gated privacy, spacious lots with generous building envelopes in a fresh newer North Scottsdale community located in the 85266 zip code? Welcome home! This serene desert community in North Scottsdale offers new homes on one acre home sites with excellent A Rated schools and lovely mountain views. It’s a short drive down Scottsdale Rd to all that North Scottsdale has to offer including world class restaurants, shopping, golf, etc.

http://www.tollbrothers.com/AZ/Saguaro_Estates

Open and large Toll Brothers floor plans are featured with Contemporary, Spanish Colonial, and Tuscan style architectural designs. 7 distinct floor plans range from approximately 3,927 square feet to 6,430 square feet. Home highlights included 3-4 bedrooms, 3.5 to 4.5 bathrooms, 3-4 car garage, media rooms, serving centers, casitas and outdoor living options.

Toll Brothers not only builds homes, but whole communities. There are a number of Toll Brother Communities in the Valley including several in the North Scottsdale and North Phoenix area. Saguaro Estates in my opinion is one Toll Brother’s crowning achievements. They are a fortune 1000 company and was recently named by Builder Magazine the 2014 Builder of the Year.

Two Toll Brother models are available onsite. Pricing begins in the low $900’s. Call Mike or Jonathan Bodeen to view this community firsthand. There are still a few good lots to choose from.

And remember, it costs you nothing to have our professional representation, but we must accompany you to the community the first time you go, or the builder is not required to pay our fee. Call us now at 602-689-3100.

North Scottsdale Zip Code Report: 85266

The 85266 Zip code, which is the most northern reaches of North Scottsdale is showing August sales to be down 29% versus 2013. The monthly median sales price in the North Scottsdale zip code is now back up to a median sales price of $620,000 compared with $605,000 one year ago and up 41% over August of 2012. Pending listings in North Scottsdale 85266 are at their lowest point since October of 2013.

![Wisdom from the Greatest Generation]()

by MICHAEL BODEEN | Sep 8, 2014 | Bodeen Team Blog, Real Estate News

I’m a boomer. Always have been. Always will be until I shed this mortal shell. There’s more of us boomers in our country than any other age demographic. You’re a boomer too if you’re currently between the age of 50-68. We’ve got changes ahead, but you’ve probably already figured that out. If you’re beyond boomer, perhaps you’ll nod affirmatively at what I’m sharing. If you’re not there yet, read on, it may do you well.

My parents were part of the greatest generation our country and perhaps this planet has ever known, but that’s just opinion, and worth little to nothing. I miss them more and more as each year rolls around. You may have had an entirely different growing up experience than I’ve had and I get that. But where we go from here is all that matters, because it’s all we got left.

From 1969 until 2004, my parents lived in a very nice Cape Cod style home in a suburban community called Marinwood. Their home was paid for, as in no mortgage. Dad was a butcher and a part owner of a small mom and pop grocery store near San Rafael, north of San Francisco, not far from where Robin Williams lived (and died) in Tiburon on the bay. In comparison, we lived on the “other side of the tracks” but in Marin County, that is way upscale compared to most anything else in the world.

Dad worked hard – very hard. His hard work and frugality (in a good sense) enabled him to retire and live well till he was 93. He was also healthy in body, soul and spirit. He lived an honorable life. Mom was, for the most part a “stay at home” mom. She passed away at the age of 78. She had smoked most of her life and it did indeed catch up with her. I think dad mourned mom’s passing for the rest of his life. Their relationship matured and blossomed after dad retired.

As I’ve now crested 60, I’ve been more considering the things that are of importance in life, which by the way, is not Fox or CNN news, or the Diamondbacks…now the Cardinals and ASU football, that may be a different story;-)

So what’s the real estate point of all this Mike? Crimeny man, would you just land the plane?!

The point is, that I believe a big part of dad’s success and health, was that he didn’t have a mortgage. He was able to save. (Mike, could you please define that word?) And then he invested, very conservatively – a little here, a little there. Fortunately for him, he had trusted advisors who did him well.

The point is, is that I (and most boomers) don’t own our homes outright. I’ve chosen instead to enjoy a nicer, larger home and having a mortgage has enabled me to do this. But you know, Karen and I are currently rethinking our life strategy and we’re definitely warming to the idea of modest and smaller versus “the nicer and bigger.”

What do you think?

![Flip or Flop?!]()

by MICHAEL BODEEN | Sep 2, 2014 | Bodeen Team Blog, Real Estate News

A number of clients and friends have asked me over the years my opinion on house flipping. “Can I actually make money doing it?” they ask. The short answer is yes you can. However, the process is NOT for the faint of heart.

By the way, what is house flipping? Very simply, flipping is (usually) the process of buying then quickly selling a home to make a profit. The idea is that one day the buyer acquires the property, quickly fixes it up, then puts it right back on the market (the flip) to sell. If you’re going to consider this endeavor, consider the following:

First, it’s imperative that the house you buy to flip is either priced well below the market and/or significantly distressed. It may take you weeks or months to find the right home to do it assuming you’re checking the market daily. You or your Realtor professional should have a good eye for the right property. As with all real estate value, location is hugely important.

From an investment standpoint, it’s best that you have cash or access to cash without having to get a new loan. There are hard money loans available (high interest – short term loans) but buyer beware, this is not recommended for most borrowers and the borrowing costs will eat into your profit.

Second, you need to know the current condition of the property you’re buying which may include more than just a typical home inspection. Make sure there are no hidden physical flaws. If you’re not well versed on the cost of renovating, it’s best that you have your contractor with you to examine the house as well. Actually it’s ALWAYS a good idea to have a second set of eyes to view your property. Also, make sure you get title insurance. Good title companies can also reduce these costs if you’re an investor and then you sell within 2-5 years. But you need to ask.

Once you’ve examined the house and know what you’re getting into, you need to determine the cost of flipping it which includes not just the physical remodeling, but also your closing and carrying costs (mortgage if any, taxes, insurance, hoa fees, utilities, title insurance, escrow fees, Realtor commission, etc). All of these costs and more go against your ultimate profit. You need to figure these costs for as long as it takes to sell the house. Your time estimate for this should be conservative.

Oh, and one other cost item that is often overlooked in the final analysis are income taxes. You will pay IRS based on your gain in the home. To defer any capital gain tax, you may want to consider doing an IRC 1031 tax deferred exchange if you’re planning on reinvesting in another investment property. (Have a chat with your CPA or tax attorney in these regards)

Once the home has been rehabbed, it’s ready to put on the market. The price you set should be a price that moves it quickly, even discounted against similar comparable sales. A home that sits on the market unsold will at a minimum be a drain on your profits. A quick sale for a very fair price will get you in and out and ready to embark on the next one!