by MICHAEL BODEEN | Feb 14, 2022 | Bodeen Team Blog, Buying a Home, Mike's "Real State" of the Market, Real Estate News

“The dream of homeownership has grown more out of reach for many middle-class Americans during the pandemic.” This is the opening line from an article in the Wall Street Journal one week ago. Check out that Article here. The exact title is “Middle Class Gets Priced out of Homes.”

That National Association of Realtors released a recent study, in which the article stated that at the end of 2019, there was one available listing that was affordable for every 24 households in the income bracket of $75,000 to $100,000. By December 2021, the figure was one listing for every 65 households! Per the WSJ, the study “found that housing affordability worsened over the past two years for all but the very wealthiest Americans, and the shrinking number of homes on the market made home buying more difficult in every income bracket.”

Metro Phoenix and Scottsdale becoming unaffordable?

As we’ve been sharing for a while now, Phoenix-Metro is becoming unaffordable with only worse prospects in (at least) the near future. Whereas just a few years ago, we were considered an affordable relocation for companies looking to move here, but that has now all but disappeared. More and more, we will be seeing articles such as: “Phoenix Ranks among the least affordable American Cities.” Check out that Article here.

Less than two years ago, the median sales price of a home in Phoenix Metro was $180 per square foot. Today it is $280 psf. Homes currently under contract continue to show further price increases as well.

To compound matters, the article accurately points out that in many areas, rents are quickly rising also, having made it more difficult for folks to save up for a down payment. This is a cruel reward for prospective buyers wanting to do the right thing to get into a house affordably.

This is certainly true of Phoenix Metro. The double whammy of rent and purchase price increases is truly eliminating any good options for our local middle class.

No laughing matter.

by MICHAEL BODEEN | Feb 7, 2022 | Bodeen Team Blog, Mike's "Real State" of the Market

I’ll fess up. It’s been easy to disparage my former state that I loved and grew up in. Hey, California is an easy target. But to be fair, every once in a while they actually surprise me in coming up with a creative idea to solve a significant problem, in this case SB 9 and SB 10. Now mind you, I’m only saying it’s creative, not necessarily good. Ripe unintended consequences will occur, and they won’t be pretty.

First of all, their significant problem is housing affordability. It’s not. That problem is sending many folks fleeing out of state to places like Arizona. The problem exists for home buyers and renters alike. Part of the problem has been cities restrictive zoning that for years has prevented much needed housing to be built in California.

So, California SB 9 and SB 10 are an attempt to provide additional housing to be built on existing single family lots. Per the San Jose Mercury News, “SB 9 is the most controversial of the two new laws. It allows property owners to split a single-family lot into two lots, add a second home to their lot or split their lot into two and place duplexes on each. The last option would create four housing units on a property currently limited to a single-family house.” Check out the article here.

Included in this new law just recently passed, is a reduction of lot line setbacks to between 0’ and 4’ to enable the new housing to be built. If it’s an empty lot in a neighborhood, it could be split into two lots allowing for two units each on each lot, thereby creating a 4-plex in a community of formerly zoned single family detached. Hmm….

Sounds good – for everyone except the folks who already live in a neighborhood that would be most impacted by the increase in local population density. Let’s say you live in a 30 year old home with a ¼ acre lot. You bought in that neighborhood back then for the large lot size, and spacious elbow room between homes. Well, guess what. The quality of life just changed for you.

Arizona, Phoenix-Metro in particular, will be in the crosshairs of government trying to help solve the severe lack of available housing we now have, and the problem has the very real probability of getting worse. If things don’t change, Arizona’s news will no longer be about myriad folks relocating to Arizona, but we will become an out-bound state for those who can no longer afford to live here. And that would be a loss!

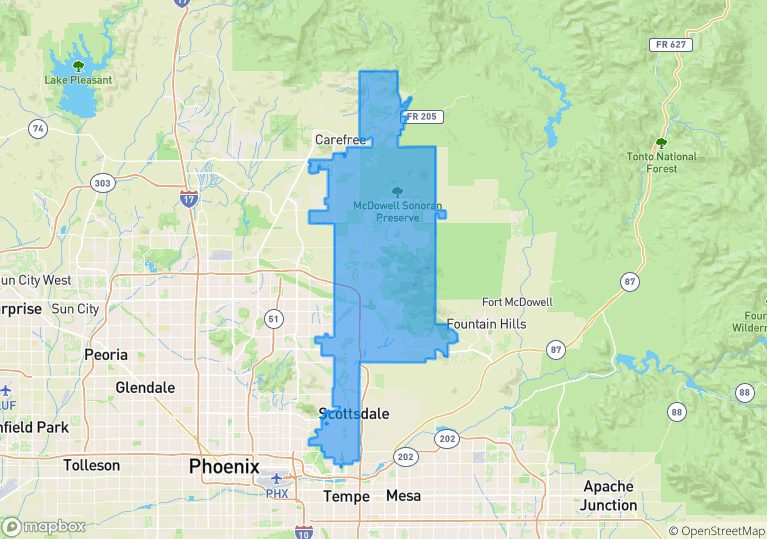

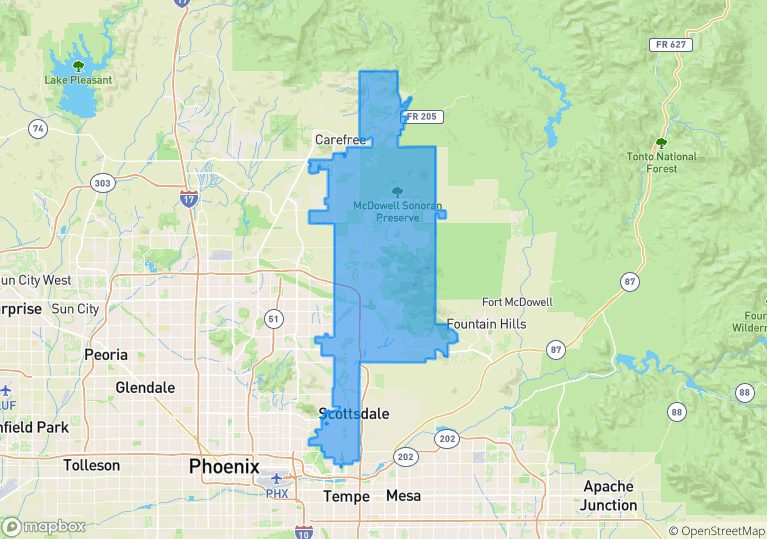

by MICHAEL BODEEN | Oct 23, 2020 | Bodeen Team Blog, Friday Focus, North Scottdale Zip Code Information, Real Estate News, Uncategorized

North Scottsdale’s 85262 zip code is home to some of the most prestigious communities in all of Arizona, which include:

- Troon North

- Estancia

- Desert Mountain

- Mirabel Club

- Carefree Ranch

- Pinnacle Canyon

- Merit Crossing

- Rio Verde

- Legend Trail

- Candlewood Estates

THIS is “North” Scottsdale! Higher elevations, gorgeous desert, city light, golf, and mountain views show off the beautiful Sonoran Desert. 85262 is one of those zips that many think (dream) about when you mention “north Scottsdale.” Just off the beaten path, it’s still close to amazing North Scottsdale shopping, dining and entertainment in Kierland, Scottsdale Quarter, and DC Ranch.

Desert Mountain, the amazing luxury golf mecca is home to some of Arizona’s most beautiful homes. Rio Verde is getting well known for large acre-plus homesites, rural living, amazing mountain / Four Peaks views, quiet and solitary living in a Covid-Post Covid era.

Troon’s name is all you have to say with nationally acclaimed golf and resort living in one of the desert’s most incredible settings.

Single Family Detached Home Pricing:

Current home prices start at $375,000 up to $19,500,000. The average list price is $2.46M. The average home sale price in the past 6 months is $1.37M. There are good home values under a Million, however, with a sale of one home at $299,000. There are 55 homes currently priced between $375,000 and $1,000,000.

Up to Date 85262 Real Estate as of October 23rd, 2020

|

Today |

Last Month |

Last Year |

1 Year Change |

| Active Listings: |

340 |

307 |

353 |

-4% |

| Pending Listings |

59 |

64 |

44 |

+34% |

| Sales Per Month |

68 |

57 |

27 |

+152% |

| Sales Per Year |

635 |

594 |

549 |

-% |

| Months of Supply |

5.0 |

5.4 |

13.1 |

– 8.1 Months |

| Appreciation – Median* |

10% |

7% |

11% |

+1% |

| Average Price – Sales** |

$1.19M |

$1,173M |

$824K |

+16% |

| Median Price – Sales*** |

$900K |

$880K |

$818K |

+10% |

*Annual Median

**Annual Average

***Annual Median

RECORD ARIZONA HOME SALE IN NORTH SCOTTSDALE

Ten Bathrooms? In my opinion, not the best lead-in for this AZ Central article describing the most expensive home sale in Arizona’s history. Being a guy, I’d probably lead with the amazing 17 acre parcel in DC Ranch’s Silverleaf with the 10 car garage, followed by 29,700 Sq Ft

https://www.azcentral.com/story/money/real-estate/done-deals/2020/10/16/arizona-housing-market-24-1-m-sale-scottsdale-mansion-sets-record/3661296001/

https://tours.tourfactory.com/tours/tour.asp?t=1098268&idx=1

Considering Buying or Selling in North Scottsdale or the Northeast Valley. Give Mike a call at 602.689.3100 or send an email to:

[email protected].

www.NorthScottsdale.com

by MICHAEL BODEEN | Nov 28, 2016 | Bodeen Team Blog, Real Estate News

This is a true story which is still ongoing; only the names have been changed. To read last week’s story,

click here.We left off last week with Dean and Pam discovering, on the day of closing, that their new home in Desert Ridge was flooded. The culprit? A newly repaired water purification system whose filter had popped off. Dean and Pam were just hours away from their moving truck arriving to unload their furnishings. Pam was asking me, “What do we do?”

The first thing we advise is to call the insurance company. Ok, but whose company do you call? Both. Though it may seem apparent that the flood began several days before closing due to the amount of water that had gushed onto the floors, and that the seller is responsible, it’s always important to let your own company know – just as in an auto accident. In this case, my client’s insurance company, USAA was quick to get a water mitigation company out there to begin the drying out process. Their philosophy seems to be to stop the bleeding first, then deal with the legalities later.

What about the seller’s insurance? Well unfortunately for her, she had cancelled her insurance just two weeks before closing, perhaps thinking she could save a few bucks. Of all the wrong moves one could make in this situation, that would be at the top of the list.

Ok, what about condo insurance? HOA’s collect money from each property owner monthly, right? Yes, but that’s for fire damage, not interior flood damage. A renter’s type policy that would cover the interior including theft, liability and comprehensive would be needed in this situation.

Finally, what about the water purification company that “repaired” the leaking system just a week before the repaired water filter popped out? What liability do they have? Well now, that’s a legal question, but it could be a direction the seller could go.

Dean and Pam finally moved in yesterday, though there is still ongoing damage in the garage that’s still being corrected and new carpeting to go on the stairs.

The seller, though distraught, has been co-operative with Dean and Pam. She is however, ultimately on the hook personally for this loss. And this is where it gets tricky. What has amazed me is how cool, calm, and collected my clients have been through this process. There are many tragedies that folks suffer through, and yes, it’s a bummer to have this inconvenience, but thankfully, no one was physically hurt. And on this Thanksgiving weekend, that is truly something to be thankful for. Somewhere down the line there will be a full conclusion to this story, and when that happens, we’ll let you know.

by MICHAEL BODEEN | Nov 21, 2016 | Bodeen Team Blog, Real Estate News

Our recent deal with Dean and Pam (not their real names) wasn’t going to be a slam dunk, but it was very do-able. They wanted to use the funds from the sale of their current home to purchase their next one, but they also did not want to have to move twice, as in selling their home and then renting while they looked for their next one. They therefore decided to do a “contingency sale.”

Contingency sales are deals that allow a buyer to make an offer on a home that is only binding if they are first able to sell their current home. This way buyers can have the comfort of having their next home locked while they try to sell their current house. Since home sales in the Valley have strengthened and our market is well “balanced,” we’re seeing these sales occur more and more.

We set them up on an automated MLS home search and began to look at some homes for sale. Dean and Pam were very agreeable to several different homes in various locations, but ultimately fell in love with great town-home that popped up on their radar. One problem though; their house was not on the market yet. They wanted to make an offer right away contingent on selling their home first.

The catch with a contingency is that sellers would often prefer not to deal with them, and for good reason. If a seller agrees to a contingency, they then must take their property off the market while the buyer’s try to get their home sold. Luckily for my clients, the town-home they wanted was already on the market for 10 months so the seller was ready to take some chances to get it sold. Fortunately, Dean and Pam had some other plusses going for them as well.

For one thing, we had gotten them pre-approved. Our lender said they were very strong borrowers. Secondly, they had a wonderful golf course home in Tatum Ranch, which was in impeccable condition and would show great. We felt it would be a relatively easy sale.

Ultimately we were not only able to convince the seller to take our contingency, but we also negotiated a lower price as well! We ended up selling their home in 30 days (not a bad time frame if I do say so myself) to a well-qualified buyer and set up the closings to sync with each other perfectly.

A few days before the closing date we completed our final walk-through and everything looked great. Well their old home and their new home both closed on time and they were all set to move… then it happened!

A few hours after closing, Pam walked up to the door of their new home, key in hand. She realized something was very wrong – and very wet. Her new home was flooded! The newly repaired water purification system had popped a filter allowing water to run from the upstairs kitchen into adjacent bedrooms then down into the garage and laundry room. Pam called me, “What do we do!?”

Many questions: Who’s at fault? Does condo insurance cover this situation? Whose insurance does cover this? What if the seller didn’t have insurance (she didn’t)? Is their liability from the water purification company who had repaired this unit the week before? How did the buyer and seller react to this unwanted and unexpected event? And what about the moving truck that would shortly arrive to deliver their furniture? Ouch!

Check in for Part 2 next week to see how this real world event concludes.

by JONATHAN BODEEN | Nov 14, 2016 | Bodeen Team Blog, Real Estate News

First let me say this is neither a pro or anti Trump article and I have taken special care to keep it that way. This is simply one person’s analysis of the facts as we have them presently.

The Financial Markets:

Many are predicting a more business friendly, pro-growth administration over the next 4 years. As a result, the markets seem to be reacting positively, at least for the most part. I won’t pretend to understand all that except as it effects real estate.

There is a trend we have noticed that when the financial markets are doing well, we tend to see an increase in the 500K+ real estate markets here in the valley. Why is that? Well when folks are feeling optimistic about their portfolios, they are more apt to go out and buy those second homes, or finally make the big move from cold country to the Valley of the Sun.

This is badly needed in our luxury markets, which are for the most part saturated in too much inventory and not enough buyers. Time will tell of course how true this will be.

When it comes to the mid-range and low-income markets (usually considered 500k and under) what matters much more is how business and growth are doing right here in the valley.

Prop 206:

Amidst all the drama of the presidential election, many may not have noticed the increase in minimum wage which passed here in Arizona, and by an overwhelming margin. Like many things in politics, opinions are sharply divided over the effects that this will have. If as some surmise, it causes a loss in jobs at the low end, you would probably see a small opening up of inventory on low-income rentals, as more folks move back in with family or with friends.

Deportation:

Many haven’t thought through the consequences of what a mass deportation would look like here in Arizona. As far as I can tell based on online research, there is something like 500,000+ undocumented immigrants living here. This is as of a 2009 study I found, who knows what it is now. If there was some sort of mass deportation what you would have is a huge opening of the low-income housing market. Inventory would probably sky-rocket and the demand would drop, resulting in a super buyer’s market and possibly decreasing prices.

Time will tell if that actually ends up happening.