by MICHAEL BODEEN | Oct 13, 2014 | Bodeen Team Blog, Mike's "Real State" of the Market, North Scottsdale News, Real Estate News

When it comes to real estate trends nationally, Arizona often leads the nation statistically. We’ve seen this happen quite a bit this past decade, where in 2004 we started seeing Phoenix area homes get snatched up and home prices significantly escalate. We then watched the rest of the nation increase as well.

Market pricing peaked in August of 2005 followed by a steep decline which bottomed out in March of 2009. Foreclosures and Short Sales were the talk of the town. Investors poured into Arizona from all over to gobble up cheap homes. Flipping came to mean something much different than turning burgers.

Unfortunately, most all other states followed Arizona’s seismic downturn too. And that trend continues today. Amazingly, Arizona is now in the top five states with the lowest foreclosure sale notices. We’ve turned around, other states have not.

Previously, the rest of the nation had been watching Arizona’s prices rise and their values followed suit. Now, Arizona is falling and, in my opinion, we’ll now observe the rest of the nation’s values likewise dropping.

Current Market Trends:

Locally, our largest cities, Phoenix and Mesa still have higher median prices currently compared to last year at this time. Phoenix one year ago had a median sales price of $179,000. Today, that median has increased to $190,000 – a 6% increase. Mesa, one year ago, was $179,950 compared to $198,500 today – an amazing 10% rise. Chandler ($255,000) and Tempe ($240,000) was a no gainer and a no loser, remaining the same. So as an owner of residential real estate, you just read the good news.

The current median sales price however for most other cities is down compared to one year ago. We have been watching this change trending over the past 6 months, and now it’s official. So, how have other cities fared this past year? Here’s a few:

Anthem: $246,000 vs $245,000. Less than 1% Price Drop.

Peoria: $230,255 vs $224,900. 2% Price Drop.

Fountain Hills: $391,950 vs $382,500. 2% Price Drop.

Scottsdale: $450,000 in 2013. $430,000 currently. 4% Price Drop.

Paradise Valley: $1,517,000 vs $1,362,000. 10% Price Drop.

So the market has changed over the past two months as previous stronger markets have weakened and a few of the weaker markets are improving.

Takeaway? Sellers, be realistic in pricing. Buyers, conditions for you continue to improve. Be ready.

by MICHAEL BODEEN | Oct 6, 2014 | Bodeen Team Blog, Real Estate News, Realtors

What we saw in toward the end of the third quarter, as I mentioned before, is a drop in supply that helped us get back to a balanced market, not favoring sellers or buyers. It seems however that we should not get too excited as there are many factors that are still counting against sellers right now.

It appears that even though there have not been a whole lot of new listings, in fact very few, demand has also begun to weaken a little from the low it was already at. The amount of listings that are pending right now has dropped nearly 6% from last month, indicating a drop in demand. The total inventory or supply of listings is up 2%, conversely indicating an ever so slight increase in supply.

Market experts are predicting an increase in listings until Thanksgiving, at which point it is expected to drop down again. What does this all mean for sellers? Well it’s a tough road right now, which means we have to be competitive in price, the best presentation possible, and a little bit of patience… ok, maybe a lot of patience.

As professional Realtors, we often tread the fine line of staying optimistic, but also reporting negative facts taking place on the ground. Thankfully, we can remain optimistic because we enjoy where we live and life is good, except when it’s not – and that’s life. If I am a person who really enjoys my home and the memories it affords me, then I’m not that concerned about what the local real estate market is doing. Least of all week to week or month to month.

I do however confess to having a penchant for being a market observer, and the main reason for that is that 90% of the time when I see a client, even casually apart from biz, they inevitably ask, “Mike, how’s the market?” I’d like to be able to intelligently answer them something other than, “I dunno.”

So when we find ourselves in the languid real estate market that we are, we need to come up with the right spin, and in this case, currently, there is an honest spin that works. Here it goes: Fence sitters, your time has come, get your financial house in order, and get ready to buy a house shortly, because there’s going to be some great buys between now and the end of the year. “I dunno Mike, sounds like Realtor hype to me.”

The truth is that we’re seeing (literally) hundreds upon hundreds of price reductions weekly. If you combine that with very low mortgage rates, and a jobs economy that’s turning around, it may very well result in a booming market. When that happens, just as in our not too distant past, prices escalate rapidly and then, in the words of Carole King, “it’s too late baby, now it’s too late…”

– Mike Bodeen

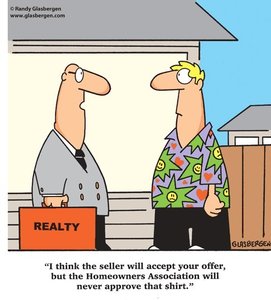

![HOAs…. Love Em or Hate Em? (Part 3)]()

by MICHAEL BODEEN | Sep 29, 2014 | Bodeen Team Blog, Real Estate News

Part 3: Get Informed First!

(HOAs Part 1)

(HOAs Part 2)

(This is the 3rd and final article regarding HOA’s – Previously we looked at the advantages and disadvantages of living in an HOA community. Today we look at the importance for buyers to understand exactly what they’re getting involved in and the best way to go about checking it out ahead of time)

Most homebuyers are not immediately concerned with a community’s homeowner association (HOA) rules and regulations unless they’ve already had their “experience” — like my client who wrote me following the first article in this series. Because of how he felt he was treated, he may not ever own a home in an HOA again. I think it’s also fair to say that his experience in his community is NOT like most communities.

The main question I get is how much are the monthly HOA’s (dues amount)? The second question is typically, “what do the dues cover?” But honestly, one of the most important parts of our AAR Purchase Contract is the HOA Addendum. Every purchase of a property in an HOA is now required to follow the rules spelled out in this addendum (partially reprinted below) because the myriad legal problems surrounding HOA’s have now become legend. I think however that HOA’s do not provide everything they’re supposed to, so it’s good to make sure they do. (See the requirements below)

Along with the requirements below there is another bit of information which may tell more about an HOA than anything else – that is the meeting minutes. There is no formal requirement in the HOA Addendum for anyone to provide these — that request needs to come from the buyer in their offer. If obtained however, the minutes can reveal important information about the HOA including, but not limited to, future capital improvement projects and associated costs, lawsuits affecting the community, ongoing HOA violations, board member perspectives, quality (or lack thereof) of work being done in the common areas, such as landscaping, painting, etc. and much more.

By law, a prospective buyer in an HOA MUST receive from the HOA:

1. A copy of the bylaws and the rules of the association.

2. A copy of the declaration of Covenants, Conditions and Restrictions (“CC&Rs”).

3. A dated statement containing association contact info, the amount of the regular assessment, special assessments, fees or charges currently owed by the seller, insurance, reserves, current violations by homeowner, statement of seller alterations, case information related to lawsuits, current operating budget, annual report, most recent reserve study, and any other information required by law.

Most importantly, whatever community you choose to consider living in you can learn a lot about its character and history by talking with the neighbors. A good time to do this is on a Saturday morning. (Just make sure you do this before the end of your ‘Due Diligence’ contract period, talk to neighbors) Most folks will be pretty honest about living there, including their experience with the HOA. You can learn a lot that rules, regulations, and financials won’t show you. In some cases you might learn some things about the house and (owners) you’re buying from. Of course, it’s also possible you would have preferred NOT to have known some uncovered juicy morsel. As a caveat, take everything said with the proverbial grain of salt.

If after all that, there’s any reason why you don’t want to buy this property, excepting fair housing issues, you can elect to cancel the agreement without forfeiture of deposit.

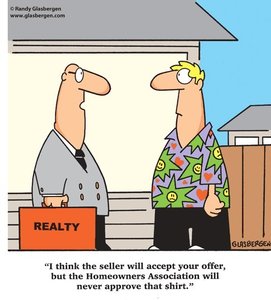

![HOAs… Love Em or Hate Em? (Part 2)]()

by MICHAEL BODEEN | Sep 22, 2014 | Bodeen Team Blog, Buying a Home, Real Estate News

(Last week we discussed the “Benefits of an HOA!” This week we’ll look at some negatives)

(Click here for Part 1)

HOA’s Run Amok!

“Gestapo Tactics!” is the term I’ve heard more than once when homeowners are venting about their HOA.

An overzealous HOA can be a royal pain to homeowners. Usually after one or more written warnings, a property owner may receive a formal complaint and directive to fix an HOA rules violation. If not fixed within that certain period of time, or after numerous warnings, a fine is assessed. When this happens the homeowner-HOA relationship heads downhill in a hurry, usually to crash and burn. And, in some cases we’ve heard that HOA’s have the authority to foreclose on a property after non-payment of fines following due process.

Often the cause for the HOA violation has to do with tenants in the home, who may or may not be aware, or who may or may not care that their car was left parked on the street overnight. In some communities, hired staff drive the hood and take photos of violations to present to the homeowner. This one enforcement detail, which is usually necessary to make a charge stick, often ticks off an owner or renter more than anything else. It’s akin to getting the photo enforcement mug shot from the City of Scottsdale in the mail.

Another cause for upset homeowners is their perception (often correct) that the HOA is being unreasonable when they turn down a homeowner request for adding or changing something to the exterior of the house. When a buyer asks us if they can “do a certain thing, or make a certain change,” our immediate comeback is that it’s up to the community rules and regs (or Design) committee – and sometimes what side of the bed they got out of that morning.

And sometimes you can be torpedoed by a neighbor. I spoke with a client recently who had called me to see if I had the number of a good HOA attorney. His next door neighbor in North Scottsdale was taking issue with his backyard new pool and landscape project and was making a fuss to the HOA which ended up delaying the project many months, missing the swim season. Fortunately he has recently gotten this resolved, but it was a real headache for him and his wife.

Don’t like the way your community is being run? Well, you can make your voice heard at a monthly HOA meeting, and you can even run for a position on the HOA board. Warning though, this position is not for the faint of heart.

I definitely touched on a nerve for some of you last week. One of my clients replied back with the following (this is a partial excerpt of what he wrote):

“HOA’s, I don’t like them!”

“They become power hungry controllers run by people who have nothing better to do and butt into everyone’s business. If I had it to do all over again I would find a neighborhood without one.

All the items you mention as unkept yards, cars on jacks can dealt with utilizing existing city codes. Yes they become like a mini Gestapo – personal experience.

Garage inspections to see if you have room to park, rigged elections, legal threats, fines, etc.”

(Next week we’ll discuss purchase contract issues that can save you hundreds of dollars, just by understanding what the purchase contract addendum states)

by MICHAEL BODEEN | Sep 15, 2014 | Mike's "Real State" of the Market, Real Estate News

It’s still a mystery, really. The inventory of homes for sale continues to drop. The amount of new listings that popped up on the market has been the lowest since July 2001. Amazingly, demand is also still dropping! In July we had the fewest amount of sales since July of 2008. It is certainly a unique situation, though I can’t say it’s bad.

According to The Cromford Report, “this is quite unusual and shows us how extreme the shortage of new listings has become. New listings have been arriving at a rate which is lower than in any August we have seen since 2001. In the last four weeks we saw 15.6% fewer new listings than last year and 13.2% fewer than in August 2012, the previous low record holder.”

The short of it is that we are now on the cusp of a balanced market here in the valley. As some of our clients can tell you, the summer has not been an easy one for sellers. inventory of homes (supply) was high and demand was low. Many of the listings on the market have either expired or been cancelled. Because of this summer’s buyer’s market, most sellers are now too timid to put their homes up for sale, which is the main factor driving the low inventory.

Ironically, this has actually created a much more balanced market, one that is more favorable to sellers than it was even a few months ago. We are no longer in a buyer’s market, we are at the threshold of balance. But how long will the decrease in inventory last? Well, that’s any ones guess.

The vast consumer mindset always seems to be 3 to 6 months behind what is actually happening in Real Estate. Most people believe we are still in the buyer’s market and have no idea it’s actually a much better time to sell than it was even a month or two ago!

To prove my point, here are the basic MLS numbers for September 1, 2014 relative to September 1, 2013 for all areas & types:

- Active Listings (inventory): 23,296 versus 18,182 last year – up 28.1% – but down 2.5% from 23,900 last month

- Pending Listings: 5,951 versus 7,302 last year – down 18.5% – and down 2.1% from 6,079 last month

- Monthly Sales: 6,417 versus 7,187 last year – down 10.7% – and down 6.2% from 6,844 last month

- Monthly Average Sales Price per Sq. Ft: $126.10 versus $119.38 last year – up 5.6% – but down 0.4% from $126.60 last month

- Monthly Median Sales Price: $196,000 versus $182,000 last year – up 7.7% – but down 0.5% from $197,000 last month

Regards,

Mike Bodeen